Gold, an investment or just a currency hedge?

Charles Dickens knew what he was saying when he coined the term “as good as gold”. Its value was recognised as far back as 4200 BC when gold artifacts were found in the Varna Necropolis in Bulgaria. The graves of the necropolis were built between 4700 and 4200 BC, indicating that the mining of gold could have started at least 7000 years ago.

Fast forward to the 21st century and gold is still held in high regard, roughly 50% of gold consumption is for jewelry, 40% for investments, and 10% in industry. Another important factor supporting gold’s value is that it’s scarce compared to other metals; it’s estimated that there are only around 170 thousand tonnes on the entire planet.

Gold’s role in the economy today

Gold’s use in manufacturing underpins its value but it also plays a role in forex and financial markets. It does not need bank or government guarantees or indeed, any third party to determine its value. Thus, it is treated by investors as a ‘safe-haven’ asset, especially when there is turmoil in the currency markets. It is also stored by central banks to act as a reserve currency in case of calamity.

Gold as a safe-haven

The rise in the value of Gold in times of global economic uncertainty is well documented and remarkably consistent. Its performance during the COVID-19 pandemic is no exception, Gold prices have risen by 28% from January to November 2020; from around $1552.24 to $1910.55 per troy ounce. The uncertainty of the trajectory of the pandemic has sent stock markets and currencies on a roller coaster ride and it appears investors are jumping to the relative safety of gold. It is important to note that there has also been considerable interest in US Treasuries and other precious metals, so the flow towards hedge assets does not stop at gold. The demand for Treasuries has caused prices to spike, which means their yields have fallen to new lows.

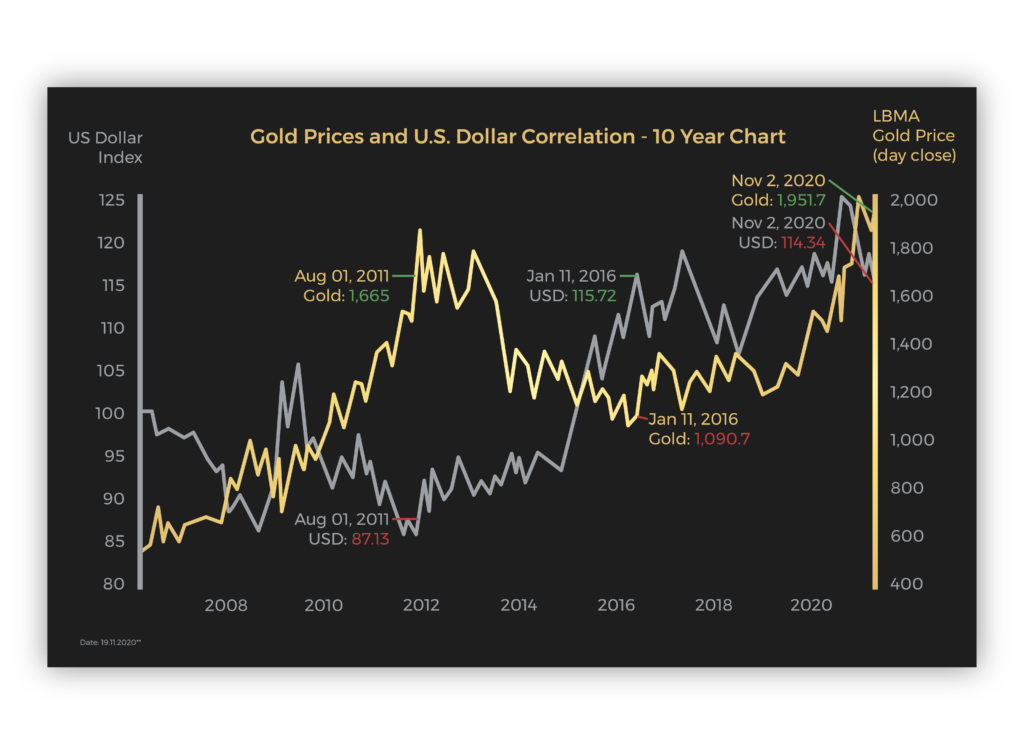

These low yields also act as an incentive to move to gold or other higher yielding investments. Bond yields are expected to remain low for some time as central banks need to keep interest rates as low as possible to encourage lending in a currently sluggish economy. In essence, when traditional bond investments offer low returns and the value of the US dollar weakens, investors move their funds to safe havens. The graph shows this direct correlation between the two since 2006.

Debt

Another element of the economic forces driving the gold price is global government debt. As economies try to manage the effect of the coronavirus on their citizen’s income, their national debt will continue to grow as they plough funds into stimulus packages and assistance programmes. Add Brexit, the terrorism threat, global civil unrest and the US elections into the mix and we have a perfect storm for market uncertainty.

Is it gold a good investment?

It is hard to ignore the facts about gold and to acknowledge its role as a safe-haven in turbulent times but there is a caveat, and many individuals get caught out by this. Gold is not a particularly good investment when you compare it to stocks and bonds over the long-term. Gold is often only in the spotlight during times of calamity, and it is not considered to be a long- term investment. It has however been a decent hedge against inflation due to its ability to protect against currency devaluation. Inflation is controlled solely by governments, and their ability to print money on demand, could potentially outpace the country’s economic growth. This Printing money often causes the value of fiat currencies to decline, reducing buying power as the price of goods and services increase. Although US inflation has been low over the last 20 years, $1 in the year 2000 would be worth $1.51 in 2020 – a 51% increase. Gold over this same period has increased 609.91% boosting holders purchasing power.

The main reason for gold underperforming as a long-term investment, is that it does not produce returns, it only has intrinsic value and you only realise returns if you sell it for a profit. Some may argue that gold coins are a better investment, but these too can be disappointing in terms of returns, especially if the melt value is significantly lower than the premium you paid for the coin. They are often subject to hype and strong-arm selling tactics and many people have been caught up in scams. Some companies even offer bullion bars for sale, you can choose to store them at home or with a custodial service. Bullion services also have risk in terms of the quality and weight assurance and the cost of insuring them.

So, while gold is enjoying its time in the sun as a hedge against current global chaos, the consensus is that while it can be a major player in protecting your currency from extreme volatility, if you are building a retirement portfolio, there are better options to consider.